Addo Sign for the financial sector

Streamline workflows with digital signatures, agreements and forms, whether it's powers of attorney, purchase agreements, mass distribution or information retrieval and provide a better and more reliable customer experience.

Efficient eSigning solution for banks and financial institutions

Addo Sign is the easiest and most advanced solution that can simultaneously provide the best overview of document distribution. Whether they need to be signed, completed or simply handled sensitively. Unlimited users are included, so you can easily use it across your organisation and in all departments.

"It is especially in the slightly larger tasks/projects that require a mass mailing and letter merging of all our employees that we have noticed a big difference. It's a pleasure to be able to keep track of everything we do in the Addo Sign overview, whatever it is."

HR-generalist

Nicoline Petz

Secure and legal validity

Addo Sign fulfils all relevant legal requirements and standards for electronic signatures. This ensures that signed documents have the necessary legal validity and integrity and that sensitive documents can be distributed in a secure and reliable way.

CPR validation

CPR validation is, as the name suggests, a function to validate a person by their CPR number. The feature can be used to check the identity of a person and validate that they are who they say they are before signing documents or filling out forms.

Create templates

Automate your repetitive contracts and agreements so you can more quickly prepare documents and capture information for information gathering/KYC, agreements and contracts or mass distribution.

Automatic reminders

Automatically send reminders to recipients so you can get signed documents back faster. Avoid having too many open cases at the same time and reduce time wasted on sending reminders.

Flows with multiple signatories

Easily distribute documents and obtain signatures from multiple parties on the same document. For example, in connection with authorisations, proofs or declarations.

Activity log

With the transaction log, you can get an overview of what activities your recipient has performed from creation to finalisation of the transaction. For example, when the documents have been opened, signed or distributed.

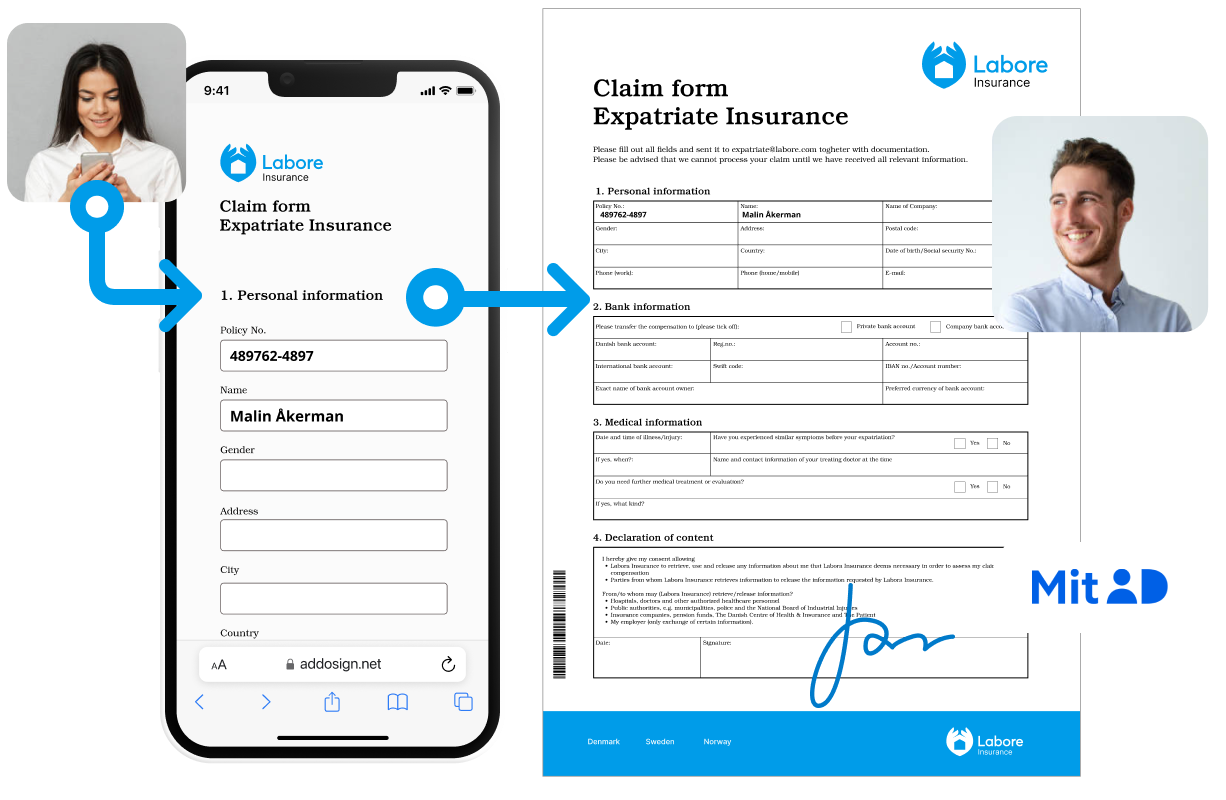

Easily collect information with Addo Forms

Collect information and transfer it directly to the company's own PDFs so that the final document can be completely customised, whether it's a purchase agreement, power of attorney, annual statement or similar. This way, the recipient only has to concentrate on filling in the information.

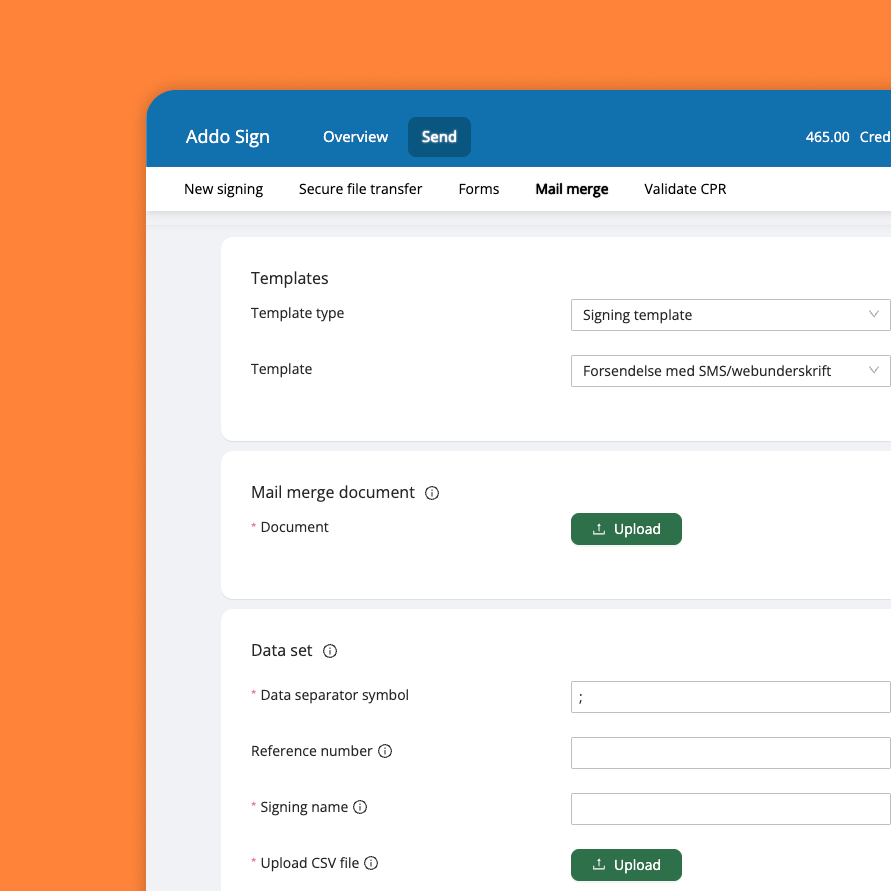

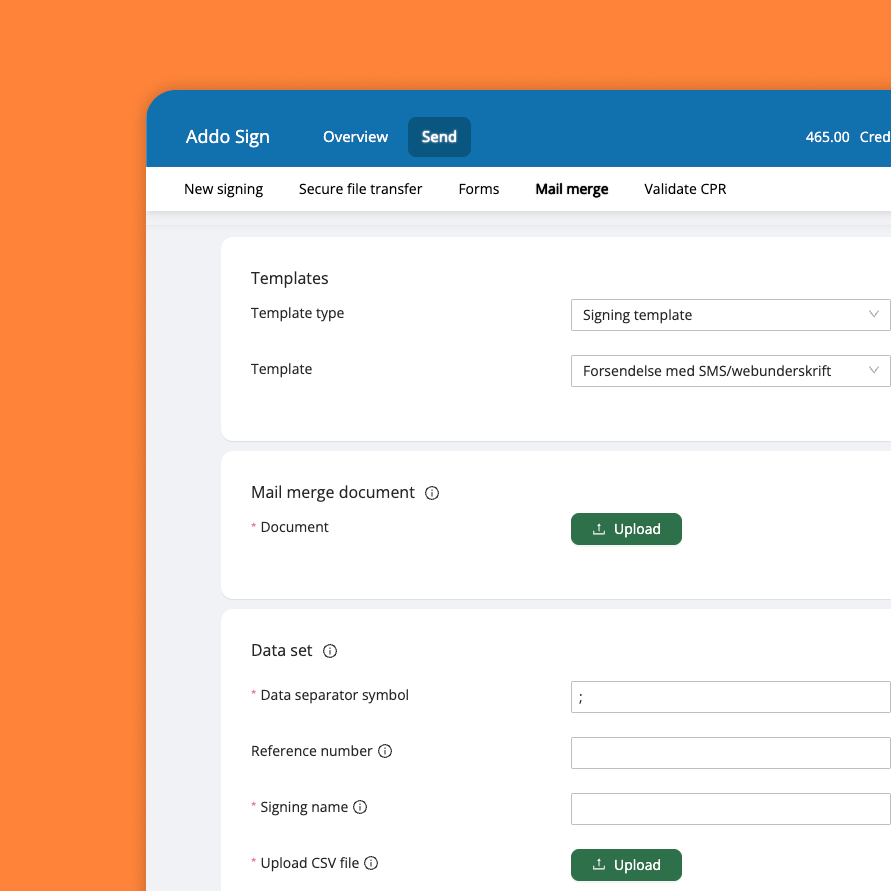

Easily send documents to different recipients with mail merge and bulk mailing

With mail merge, you can create a mass mailing with just a few clicks and send the same documents to multiple recipients. Whether it's a notice of a general meeting, sending out minutes, bylaws, etc. or changes to terms and conditions.

Once all parties have signed the document, they receive an electronic copy. The document is also automatically archived directly in your case and document management system.

Distribuer dokumenter direkte til Digital Post og MitID

Med en Digital Post-integration bliver du som offentlig myndighed klar til at distribuere dokumenter til digital signering. Du kan dermed møde borgerne i overensstemmelse med de fællesoffentlige principper for anvendelse af digital post, også når det gælder indhentning af elektronisk underskrift på dokumenter.

Read more about Digital Post

What you get from signing digitally

As a bank or financial advisor, there are several benefits to having clients and customers sign documents digitally. With advanced cryptographic signatures and audit trails, Addo Sign ensures that all signed documents are protected against tampering and forgery. Furthermore, Addo Sign enables a more streamlined process of document management, making it easy to organise, track and archive all signed documents directly from the platform, reducing administrative burdens and improving traceability throughout processes.

Flexible document and signature flows

With Addo Sign, it's easy to distribute documents that need to be signed. You get full overview of the signature process and the document's status, as well as control over the sequence of who needs to sign when. This applies regardless of the type of documents.

Contracts: Purchase agreements, lease contracts, employment contracts, construction contracts, etc.

Wills and testamentary documents: Wills, living wills, codicils, etc.

Power of attorney documents: Healthcare proxies, living will declarations, durable powers of attorney, etc.

Business documents: Articles of incorporation, bylaws, minutes of meetings, director's declarations, etc.

Family law documents: Divorce papers, parenting agreements, adoption papers, prenuptial agreements, etc.

Financial documents: Loan agreements, guarantees, securities purchase agreements, etc.

Tax documents: Tax agreements, tax information, tax declarations, etc.

Real estate documents: Deeds, mortgages, lease agreements, easements, etc.

Regulatory documents: Agreements, statutes, regulatory announcements, regulations, etc.

Insurance documents: Insurance policies, insurance claims, insurance contracts, etc.

Company documents: Minutes of meetings, board meeting protocols, capital change resolutions, bylaws, etc.

Top-notch legitimacy and data protection

Addo Sign fully complies with both the technical and legal requirements of GDPR and the General Data Protection Regulation. Therefore, sensitive personal data will never be sent as a simple text.

In return, all transactions and actions are automatically recorded, so you always have full control over documentation.

Unlimited users

Create multiple users under one account at no extra cost and with easy rights management.Secure identification

Recipients can identify themselves with MitID, Swedish BankID or Norwegian BankID when signing documents digitally.